From Suppliers Real Estate

Wholesaling is different from different kinds of purchasing real-estate because doing so is not going to demand that you put your personal cash at risk or hold onto a property for the extended period of time.

You cannot really need to rehabilitate or renovate any houses, handle owners of the house, or worry about a property’s value changing as time passes. There are many critical points you will understand about wholesaling real-estate before beginning.

We will protect every one of them below, demonstrate a few examples, supply a check-list you can use to get started wholesaling when you find the right property or home.

Real estate investment wholesaling involves selling real estate, a wholesaler / retailer, and a ending client - somebody that eventually expenses the home in the wholesaler / retailer. The retailer lists a house for sale (usually a single requiring remodeling) and it's got into contact with through the wholesaler / retailer.

The dealer operates like the middleman and welcomes a before-published obtain the purchase with the home - but doesn’t choose the property their selves. Alternatively, they “shop” the property around to curious purchasers.

After they get a customer, the selling commitment is applicable, plus the dealer merely collects a project payment on the transaction. This could be a portion of your total selling price.

It may be the visible difference within the quantity the owner formerly requested the home and property as well as total the wholesaler experienced a consumer agree with. Anyway look at a case in point beneath. Who typically tends to buy attributes from vendors?

This is typically other real estate investors who is able to count on the wholesaler to discover homes costed underneath market value. In spite of the charge, the dealer takes out from the selling price, the asking price of the house will probably be a lesser amount than a building that has been “fixed and switched.”

Wholesaling As opposed to. Mend and Use

Wholesaling isn't same method as “fix and turn.” Listed below are the leading variances between these two real estate investment strategies.

In advance funds needed. Resolve and change investors obtain and refurbish a building to at some point market it for the higher price https://wholesalinghousesinfo.com/wholesaling-houses-step-by-step-guide-for-beginners/ in comparison to bought it for. Wholesalers do not need any investment capital upfront - their technique is to find a consumer and take a charge from the selling price.

Servicing and repairs. Mend and turn buyers are to a great extent in the house - if they are not generating the vehicle repairs and restorations their selves, they are getting deckie's to make it work. Each and every coin can come out of their personal wallet.

Merchants, on the other hand, are not liable for virtually every repair, rehabilitate, or renovation plans. That is the end consumer’s accountability.

House control. Mend and switch shareholders basically unique the components they may be renovation. Wholesalers under no circumstances personal the components they stand for for traders. They may be strictly the intermediary throughout the exchange.

Duration of engagement. A fix and flip investor possesses the house as long as they demand. They could make use of a family house to offer it rapidly or want to keep it consistently to create hire cash flow from that.

Wholesale suppliers are participating on a really quick-expression foundation. When the commitment elephant seals while using customer, they usually gather their fee, their contribution finishes. Even though there are several similarities in between the two of these investment strategies, the targets of fix and use traders are very different through the desired goals of property merchants.

Wholesaling real estate property can be an great way to segue into fixing and tossing components later on. You will find out about the property sale made practice at length, have a improved comprehension of the property industry in the area, and fulfill other real estate investors who one can learn so much from.

Below wholesale Real Estate Investment Instance

We will consider an example to get it all up. Women gets a family house but isn't going to want to handle the range of maintenance tasks it has to sell it at market value. She leaves the house and property for sale at Usd75,000 and is also acknowledged by way of a wholesaler / retailer.

The dealer offers to easily discover a customer for your home that can surpass her selling price around the issue that they are allowed to keep the big difference. She confirms, as well as wholesaler contact lenses some property investors to find out if they had consider the exact property at Dollar85,000.

When one of many people agrees to order the home at Money85,000, the wholesaler helps to keep the Money10,000 alteration in the wondering and purchase value. Which is the fascinating part about wholesaling real estate investment.

On this model, the middleman collected a Buck10,000 revenue without possibly adding capital, proudly owning your house, fretting about maintenance, controlling tenants, or coping with the inevitable sale of the purchase property.

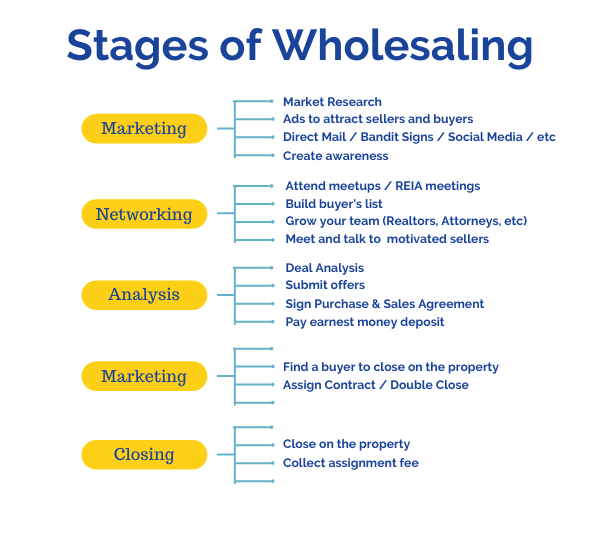

If you think wholesaling housing fits your needs, look into our checklist listed below to check out ways you can started.

Wholesaling List

Create a list of customers. It’s valuable if you are linked with several real estate investors that can love purchase components remaining brought to them instead of looking for them out. When you're not already, you might join your local Real Estate Investors Organization (REIA) to meet up with other investors close to you.

Find the right property. The next thing is finding a “distressed” property or home (one that desires maintenance or remodeling) that is definitely outlined for the low price and will be easy for investors. Affected qualities may very well have determined retailers who are going to pay a decrease offer.

When you are contemplating thus, making this an entire-time goal, you can attain encouraged vendors who may wish to sell for a small expense. Do this by buying provides of property holders who happen to be dealing a significant life alter (divorce, adjust of work, real estate receivers, those who are regarding on residence fees, and so forth).

Seek information. You simply must do some local analysis to find out if the retail price suits the house and property. Also look at what kinds of vehicle repairs the final shopper will have to buy.

If the complete ceiling should be changed, that's exactly an even bigger purchase than updating some exterior or shredding out rug. You would like to be sure that the package you are always offering to traders is they can make the most of in the end.

Make a suggestion. Speak with the retailer about the fixes and makeovers the home will be needing. Explain you will privately locate a client that is able to meet or exceed the amount of your present and that you would maintain your big difference or get hold of an assignment rate.

Try to remember: Produce a fair supply that's small enough to go out of you enough bedroom to have a gain around the sale, although not so minimal that it’s bothersome towards home owner.

Squeeze in a contingency. One time you have created an offer and the seller has acknowledged it, you are going to enter into an order commitment. This protects the owner and you simply. As a dealer, you should not be responsible for the real estate when your work be unsuccessful, and you just cannot discover a shopper. You might give a concurrent to the obtain plan giving you a chance to departure the offer if you don’t get a buyer in time.

Get a consumer. Ultimately, finding a buyer is often a stage you probably should start contemplating a great deal before in the act - as soon as you find the correct home, you should begin asking investors you understand if they’d become or start reaching out to. Without a buyer, you won’t make any gain wholesaling.

Determine your charge. If the shopper is just about to shut within the property, you will build your mission rate on the customer. You may want your money distinction the amount for your present and also the volume the customer invested in for, a portion on the complete sale made, or a set amount. As soon as your fee is resolute, the rest is documents.

Execute an assignment of commitment understanding. The acquisition contract you signed while using seller prior to can be given to the client, liberating you against any debt and relocating these to the retailer. It retains each of the terms of the first deal. After such a thing happens, you could possibly obtain a deposit on the client since you loose time waiting for closing.

Obtain your rate. At closing, the customer will have the available income to the two buy the real estate and pay your work cost. The concept corporation you utilize will write that you' check for the whole quantity of your job price.

When considering this, is that this something you can observe on your own undertaking? Wholesaling may be the appropriate expense technique for you in case you fulfill the pursuing conditions:

- You no longer need plenty of investment capital to speculate in advance - You’re not sure about investing your money into real estate investment - Your credit ranking avoids from finding funding - One doesn't want the hassle of managing problems and refurbishments - You do not want to produce real estate repair over time - You don’t want to cope with renters and get hold of hire - You prefer a quick-phrase investment decision to your prolonged-phrase 1 - You'd like to explore housing and repair with investors - You imagine you will discover intrigued buyers - You could be an excellent negotiator and communicator - You have an understanding of housing, or are able to master

That's why wholesaling is a wonderful “entry-level” way of getting into rei. In reality, wholesaling can present you with the cash you'll want to start making more and larger worthwhile opportunities. The gains you create originating from a several below wholesale houses may very well be ample that you can invest in a fixer-top with income.